About us

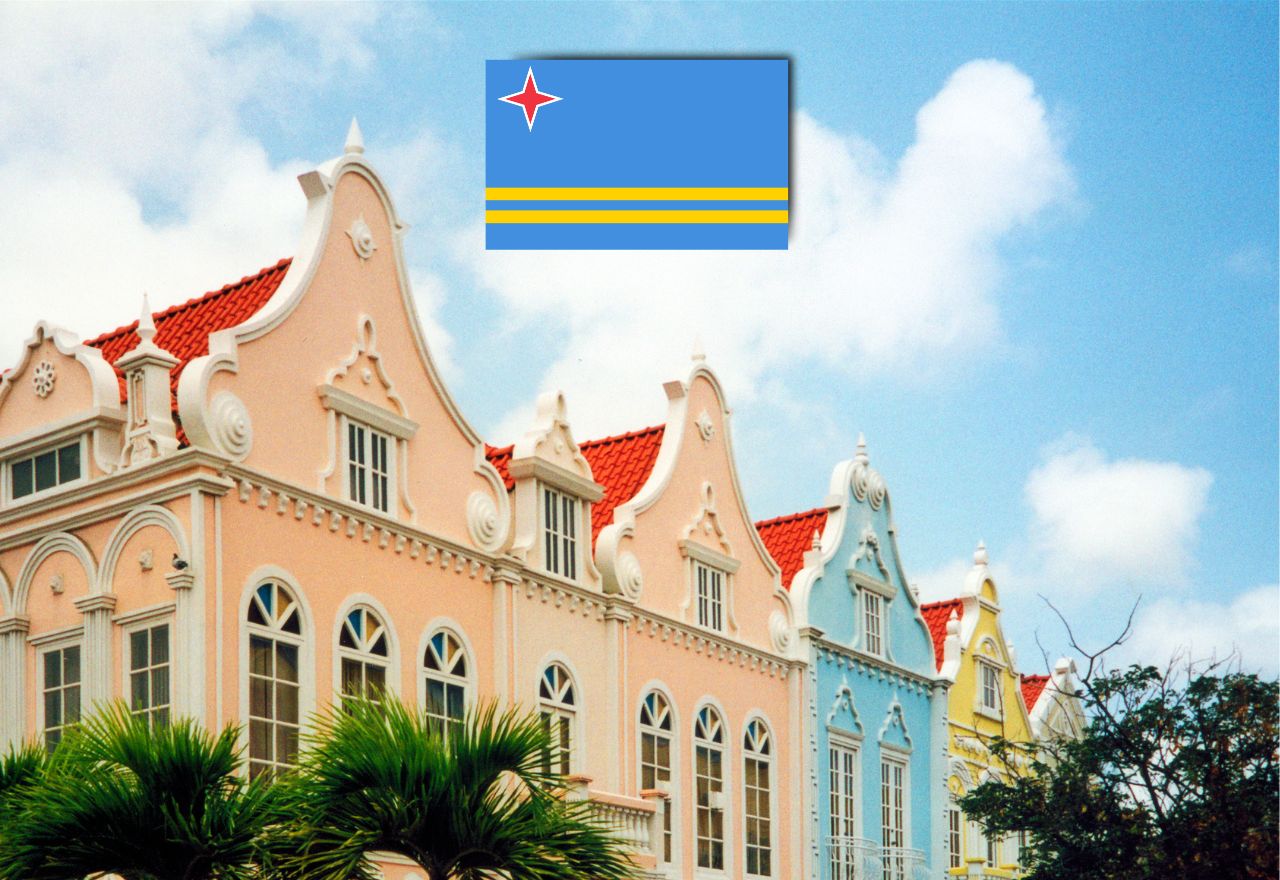

We are a global leading provider of audit, tax, and advisory services. With 16 offices in the Caribbean operating across 18 markets, our local presence in the Caribbean region is unmatched. By working closely together across our service lines, we offer our clients the added value they are looking for.